如何使用Java + React計算個人所得稅?

前言

在報表資料處理中,Excel公式擁有強大而多樣的功能,廣泛應用於各個業務領域。無論是投資收益計算、財務報表編制還是保險收益估算,Excel公式都扮演著不可或缺的角色。傳統的做法是直接依賴Excel來實現複雜的業務邏輯,並生成相應的Excel檔案。因此只需在預設位置輸入相應引數,Excel公式即可被啟用,迅速計算並呈現結果。正因如此,在這類場景中,企業積累了大量用於計算的Excel檔案,它們已經成為了無價的財富。

然而,傳統的Excel檔案方式存在難以管理和資料不安全的缺點。為了解決這些問題,可以採用B/S架構+Excel元件庫的方式。

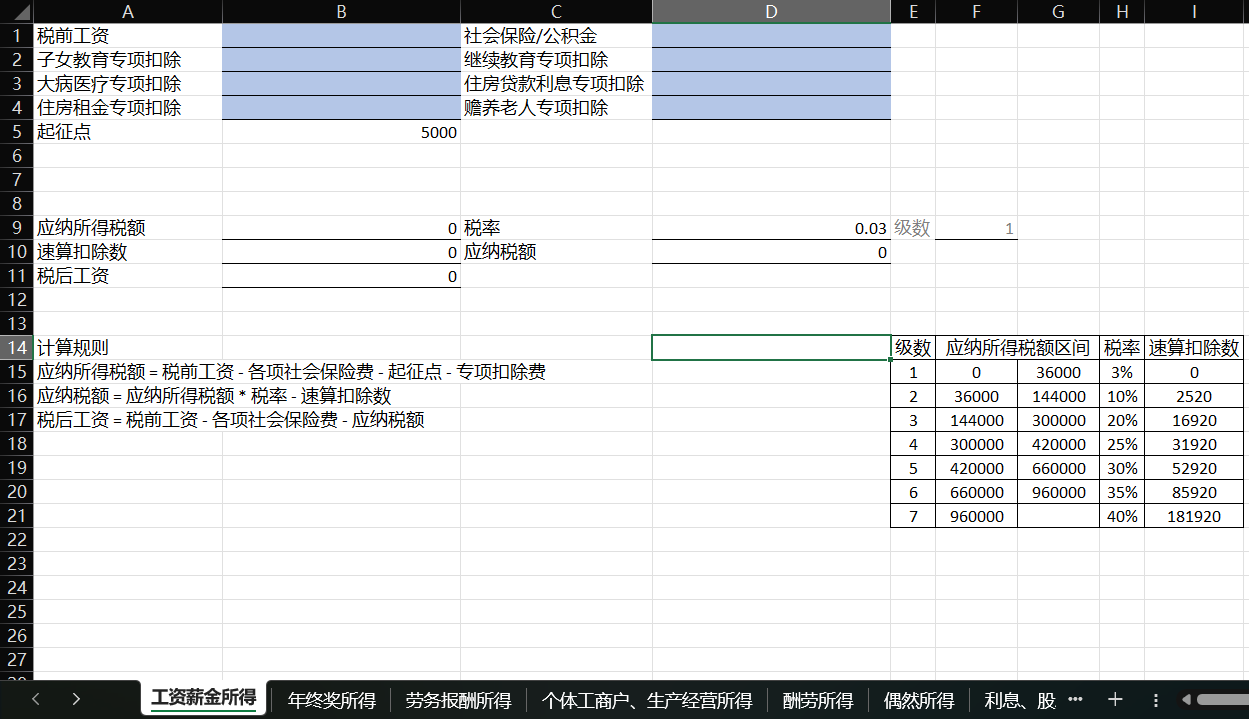

本文將以個人所得稅的計算為例,使用React+Spring Boot+GcExcel來實現。首先準備好Excel檔案,按照國家稅務總局提供的個稅計算頁面進行建立。

個人所得稅的收入型別有8種:

- 工資薪金所得

- 年終獎所得

- 勞務報酬所得

- 個體工商戶、生產經營所得

- 酬勞所得

- 偶然所得

- 利息、股息、紅利所得

- 財產轉讓所得

其中,工資薪金所得最為複雜,包括社會保險和專項扣除。每種型別的計稅方式都不同,為了便於理解,我們為每個型別建立了一個工作表進行計算。

以下是準備好的Excel檔案,其中藍色部分為需要輸入引數的單元格,其他單元格將自動計算。

完成準備工作後,下面開始前後端工程的搭建。

實踐

前端 React

建立React工程

新建一個資料夾,如TaxCalculator,進入資料夾,在資源管理器的位址列裡輸入cmd,然後回車,開啟命令列視窗。使用下面的程式碼建立名為client-app的react app。

npx create-react-app salary-client

進入剛建立的salary-client資料夾,使用IDE,比如VisualStudio Code開啟資料夾。

介面部分

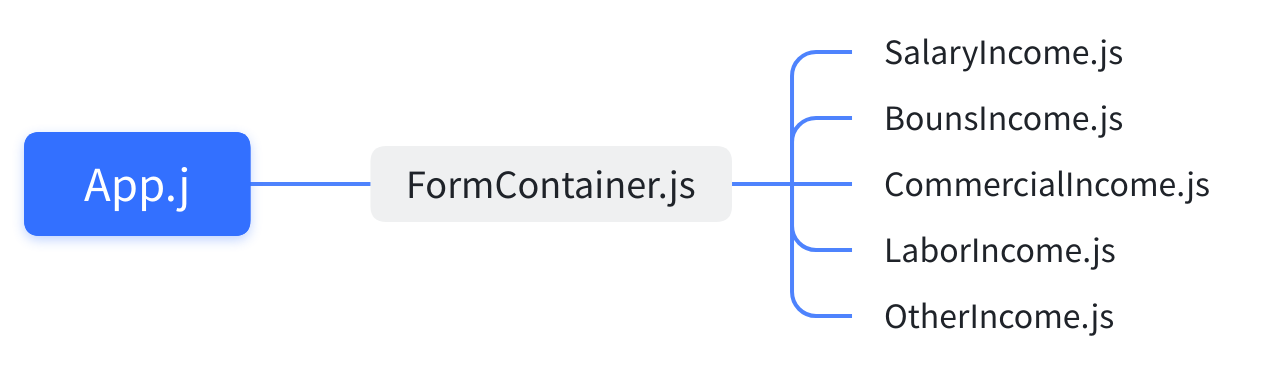

個人所得稅涉及的收入型別一共有8種,其中(「酬勞所得」,「偶然所得」,「利息、股息、紅利所得」,「財產轉讓所得」)四種的計算方式接近,UI佈局相似,藉助React的component特性,最終需要提供5種表單介面。

如下圖所示:

為了讓UI看起來更好看一些,可以先引入一個UI框架,這裡我們使用了MUI。

npm install @mui/material @emotion/react @emotion/styled

首先,更新Src/App.js的程式碼,其中新增了DarkMode的Theme, 程式碼如下:

import './App.css';

import { ThemeProvider } from '@emotion/react';

import { createTheme } from '@mui/material';

import { FormContainer } from './Component/FormContainer';

const darkTheme = createTheme({

palette: {

mode: 'dark',

},

});

function App() {

return (

<ThemeProvider theme={darkTheme}>

<div className="App-header">

<h2>個人所得稅計算器</h2>

<FormContainer></FormContainer>

</div>

</ThemeProvider>

);

}

export default App;

可以看到,App.js中參照了FormContainer,下來新增 ./Component/FormContainer.js。

FormContainer主要是提供一個Selector,讓使用者選擇收入型別,根據選擇的型別渲染不同的元件。

import React, { useState } from 'react';

import { SalaryIncome } from "./SalaryIncome"

import { NativeSelect, FormControl } from '@mui/material';

import { BounsIncome } from './BounsIncome';

import { CommercialIncome } from './CommercialIncome';

import { LaborIncome } from './LaborIncome';

import { OtherIncome } from './OtherIncome';

export const FormContainer = () => {

const [calcType, setCalcType] = useState("工資薪金所得");

const GetIncomeControl = () => {

switch (calcType) {

case "工資薪金所得":

return <SalaryIncome calcType={calcType}></SalaryIncome>;

case "年終獎所得":

return <BounsIncome calcType={calcType}></BounsIncome>;

case "勞務報酬所得":

return <LaborIncome calcType={calcType}></LaborIncome>;

case "個體工商戶、生產經營所得":

return <CommercialIncome calcType={calcType}></CommercialIncome>;

default:

return <OtherIncome calcType={calcType}></OtherIncome>;

}

}

return (

<div style={{ width: "60vw", marginTop: "5vh" }}>

<FormControl fullWidth sx={{ marginBottom: 2 }}>

<NativeSelect labelId="demo-simple-select-label" id="demo-simple-select"

value={calcType} label="型別" onChange={e => setCalcType(e.target.value)} >

<option value="工資薪金所得">工資薪金所得</option>

<option value="年終獎所得">年終獎所得</option>

<option Item value="勞務報酬所得">勞務報酬所得</option>

<option value="個體工商戶、生產經營所得">個體工商戶、生產經營所得</option>

<option value="酬勞所得">酬勞所得</option>

<option value="偶然所得">偶然所得</option>

<option value="利息、股息、紅利所得">利息、股息、紅利所得</option>

</NativeSelect>

</FormControl>

{GetIncomeControl()}

</div>);

}

例如:<SalaryIncome calcType={calcType}></SalaryIncome>; 同時會將calcType傳遞進去。

接下來,分別建立幾個xxxIncome元件。

1.工資薪金所得 SalaryIncome.js

import React, { useState } from 'react';

import { TextField, Button, Stack } from '@mui/material';

import axios from 'axios';

export const SalaryIncome = (props) => {

const [income, setIncome] = useState("");

const [insurance, setInsurance] = useState("");

const [childEdu, setChildEdu] = useState("");

const [selfEdu, setSelfEdu] = useState("");

const [treatment, setTreatment] = useState("");

const [loans, setLoans] = useState("");

const [rent, setRent] = useState("");

const [elder, setElder] = useState("");

const [taxableIncome, setTaxableIncome] = useState("");

const [taxRate, setTaxRate] = useState("");

const [deduction, setDeduction] = useState("");

const [tax, setTax] = useState("");

const [takeHomeSalary, setTakeHomeSalary] = useState("");

async function calculateTax(event) {

event.preventDefault();

let res = await axios.post("api/calcPersonTax", {

calcType: props.calcType,

income: income,

insurance: insurance,

childEdu: childEdu,

selfEdu: selfEdu,

treatment: treatment,

loans: loans,

rent: rent,

elder: elder,

});

if (res != null) {

let data = res.data;

setTaxableIncome(data.taxableIncome);

setTaxRate(data.taxRate);

setDeduction(data.deduction);

setTax(data.tax);

setTakeHomeSalary(data.takeHomeSalary);

}

}

function reset(event) {

event.preventDefault();

setIncome("");

setInsurance("");

setChildEdu("");

setSelfEdu("");

setTreatment("");

setLoans("");

setRent("");

setElder("");

setTaxableIncome("");

setTaxRate("");

setDeduction("");

setTax("");

setTakeHomeSalary("");

}

return (

<div>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='primary'

label="稅前工資" onChange={e => setIncome(e.target.value)}

value={income} fullWidth required size="small"/>

<TextField type="text" variant='outlined' color='secondary'

label="社會保險/公積金" onChange={e => setInsurance(e.target.value)}

value={insurance} fullWidth size="small"/>

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary'

label="子女教育專項扣除" onChange={e => setChildEdu(e.target.value)}

value={childEdu} fullWidth size="small"/>

<TextField type="text" variant='outlined' color='secondary'

label="繼續教育專項扣除" onChange={e => setSelfEdu(e.target.value)}

value={selfEdu} fullWidth size="small"/>

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary'

label="大病醫療專項扣除" onChange={e => setTreatment(e.target.value)}

value={treatment} fullWidth size="small"/>

<TextField type="text" variant='outlined' color='secondary'

label="住房貸款利息專項扣除" onChange={e => setLoans(e.target.value)}

value={loans} fullWidth size="small"/>

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary'

label="住房租金專項扣除" onChange={e => setRent(e.target.value)}

value={rent} fullWidth size="small"/>

<TextField type="text" variant='outlined' color='secondary'

label="贍養老人專項扣除" onChange={e => setElder(e.target.value)}

value={elder} fullWidth size="small"/>

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary'

label="起徵點" value="5000 元/月" fullWidth disabled size="small"/>

</Stack>

<hr></hr>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<Button variant="outlined" color="primary" onClick={calculateTax} fullWidth size="large">計算</Button>

<Button variant="outlined" color="secondary" onClick={reset} fullWidth size="large">重置</Button>

</Stack>

<hr></hr>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary'

label="應納稅所得額" value={taxableIncome} fullWidth disabled size="small"/>

<TextField type="text" variant='outlined' color='secondary'

label="稅率" value={taxRate} fullWidth disabled size="small"/>

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary'

label="速算扣除數" value={deduction} fullWidth disabled size="small"/>

<TextField type="text" variant='outlined' color='secondary'

label="應納稅額" value={tax} fullWidth disabled size="small"/>

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary'

label="稅後工資" value={takeHomeSalary} fullWidth disabled size="small"/>

</Stack>

</div>

)

}

2.年終獎金所得 BounsIncome.js

import React, { useState } from 'react';

import { TextField, Button, Stack } from '@mui/material';

import axios from 'axios';

export const BounsIncome = (props) => {

const [income, setIncome] = useState("");

const [taxableIncome, setTaxableIncome] = useState("");

const [taxRate, setTaxRate] = useState("");

const [deduction, setDeduction] = useState("");

const [monthlyWage, setMonthlyWage] = useState("");

const [tax, setTax] = useState("");

const [takeHomeSalary, setTakeHomeSalary] = useState("");

async function calculateTax(event) {

event.preventDefault();

let res = await axios.post("api/calcPersonTax", {

calcType: props.calcType,

income: income,

});

if (res != null) {

let data = res.data;

setTaxableIncome(data.taxableIncome);

setTaxRate(data.taxRate);

setDeduction(data.deduction);

setMonthlyWage(data.monthlyWage);

setTax(data.tax);

setTakeHomeSalary(data.takeHomeSalary);

}

}

function reset(event) {

event.preventDefault();

setIncome("");

setTaxableIncome("");

setTaxRate("");

setDeduction("");

setMonthlyWage("");

setTax("");

setTakeHomeSalary("");

}

return (

<div>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='primary' size="small"

label="稅前工資" onChange={e => setIncome(e.target.value)}

value={income} fullWidth required />

</Stack>

<hr></hr>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<Button variant="outlined" color="primary" onClick={calculateTax} fullWidth size="large">計算</Button>

<Button variant="outlined" color="secondary" onClick={reset} fullWidth size="large">重置</Button>

</Stack>

<hr></hr>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="應納稅所得額" value={taxableIncome} fullWidth disabled />

<TextField type="text" variant='outlined' color='secondary' size="small"

label="稅率" value={taxRate} fullWidth disabled />

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="速算扣除數" value={deduction} fullWidth disabled />

<TextField type="text" variant='outlined' color='secondary' size="small"

label="平均每月工資" value={monthlyWage} fullWidth disabled />

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="應納稅額" value={tax} fullWidth disabled />

<TextField type="text" variant='outlined' color='secondary' size="small"

label="稅後工資" value={takeHomeSalary} fullWidth disabled />

</Stack>

</div>

)

}

3.勞務報酬所得 LaborIncome.js

import React, { useState } from 'react';

import { TextField, Button, Stack } from '@mui/material';

import axios from 'axios';

export const LaborIncome = (props) => {

const [income, setIncome] = useState("");

const [taxableIncome, setTaxableIncome] = useState("");

const [taxRate, setTaxRate] = useState("");

const [deduction, setDeduction] = useState("");

const [nonTaxablePart, setNonTaxablePart] = useState("");

const [tax, setTax] = useState("");

const [takeHomeSalary, setTakeHomeSalary] = useState("");

async function calculateTax(event) {

event.preventDefault();

let res = await axios.post("api/calcPersonTax", {

calcType: props.calcType,

income: income,

});

if (res != null) {

let data = res.data;

setTaxableIncome(data.taxableIncome);

setTaxRate(data.taxRate);

setDeduction(data.deduction);

setNonTaxablePart(data.nonTaxablePart);

setTax(data.tax);

setTakeHomeSalary(data.takeHomeSalary);

}

}

function reset(event) {

event.preventDefault();

setIncome("");

setTaxableIncome("");

setTaxRate("");

setDeduction("");

setNonTaxablePart("");

setTax("");

setTakeHomeSalary("");

}

return (

<div>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='primary' size="small"

label="稅前工資" onChange={e => setIncome(e.target.value)}

value={income} fullWidth required />

</Stack>

<hr></hr>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<Button variant="outlined" color="primary" onClick={calculateTax} fullWidth size="large">計算</Button>

<Button variant="outlined" color="secondary" onClick={reset} fullWidth size="large">重置</Button>

</Stack>

<hr></hr>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="應納稅所得額" value={taxableIncome} fullWidth disabled />

<TextField type="text" variant='outlined' color='secondary' size="small"

label="稅率" value={taxRate} fullWidth disabled />

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="速算扣除數" value={deduction} fullWidth disabled />

<TextField type="text" variant='outlined' color='secondary' size="small"

label="減除費用" value={nonTaxablePart} fullWidth disabled />

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="應納稅額" value={tax} fullWidth disabled />

<TextField type="text" variant='outlined' color='secondary' size="small"

label="稅後工資" value={takeHomeSalary} fullWidth disabled />

</Stack>

</div>

)

}

4.個體工商戶、生產經營所得 CommercialIncome.js

import React, { useState } from 'react';

import { TextField, Button, Stack } from '@mui/material';

import axios from 'axios';

export const CommercialIncome = (props) => {

const [income, setIncome] = useState("");

const [taxableIncome, setTaxableIncome] = useState("");

const [taxRate, setTaxRate] = useState("");

const [deduction, setDeduction] = useState("");

const [tax, setTax] = useState("");

const [takeHomeSalary, setTakeHomeSalary] = useState("");

async function calculateTax(event) {

event.preventDefault();

let res = await axios.post("api/calcPersonTax", {

calcType: props.calcType,

income: income,

});

if (res != null) {

let data = res.data;

setTaxableIncome(data.taxableIncome);

setTaxRate(data.taxRate);

setDeduction(data.deduction);

setTax(data.tax);

setTakeHomeSalary(data.takeHomeSalary);

}

}

function reset(event) {

event.preventDefault();

setIncome("");

setTaxableIncome("");

setTaxRate("");

setDeduction("");

setTax("");

setTakeHomeSalary("");

}

return (

<div>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='primary' size="small"

label="稅前工資" onChange={e => setIncome(e.target.value)}

value={income} fullWidth required />

</Stack>

<hr></hr>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<Button variant="outlined" color="primary" onClick={calculateTax} fullWidth size="large">計算</Button>

<Button variant="outlined" color="secondary" onClick={reset} fullWidth size="large">重置</Button>

</Stack>

<hr></hr>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="應納稅所得額" value={taxableIncome} fullWidth disabled />

<TextField type="text" variant='outlined' color='secondary' size="small"

label="稅率" value={taxRate} fullWidth disabled />

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="速算扣除數" value={deduction} fullWidth disabled />

<TextField type="text" variant='outlined' color='secondary' size="small"

label="應納稅額" value={tax} fullWidth disabled />

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="稅後工資" value={takeHomeSalary} fullWidth disabled />

</Stack>

</div>

)

}

5.餘下四種型別 OtherIncome.js

import React, { useState } from 'react';

import { TextField, Button, Stack } from '@mui/material';

import axios from 'axios';

export const OtherIncome = (props) => {

const [income, setIncome] = useState("");

const [taxableIncome, setTaxableIncome] = useState("");

const [taxRate, setTaxRate] = useState("");

const [tax, setTax] = useState("");

const [takeHomeSalary, setTakeHomeSalary] = useState("");

async function calculateTax(event) {

event.preventDefault();

let res = await axios.post("api/calcPersonTax", {

calcType: props.calcType,

income: income,

});

if (res != null) {

let data = res.data;

setTaxableIncome(data.taxableIncome);

setTaxRate(data.taxRate);

setTax(data.tax);

setTakeHomeSalary(data.takeHomeSalary);

}

}

function reset(event) {

event.preventDefault();

setIncome("");

setTaxableIncome("");

setTaxRate("");

setTax("");

setTakeHomeSalary("");

}

return (

<div>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='primary' size="small"

label={props.calcType} onChange={e => setIncome(e.target.value)}

value={income} fullWidth required />

</Stack>

<hr></hr>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<Button variant="outlined" color="primary" onClick={calculateTax} fullWidth size="large">計算</Button>

<Button variant="outlined" color="secondary" onClick={reset} fullWidth size="large">重置</Button>

</Stack>

<hr></hr>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="應納稅所得額" value={taxableIncome} fullWidth disabled />

<TextField type="text" variant='outlined' color='secondary' size="small"

label="稅率" value={taxRate} fullWidth disabled />

</Stack>

<Stack spacing={2} direction="row" sx={{ marginBottom: 2 }}>

<TextField type="text" variant='outlined' color='secondary' size="small"

label="應納稅額" value={tax} fullWidth disabled />

<TextField type="text" variant='outlined' color='secondary' size="small"

label="稅後工資" value={takeHomeSalary} fullWidth disabled />

</Stack>

</div>

)

}

此時,完成UI部分後,可以嘗試執行起來,效果如下:

//通過程式碼執行React app

npm start

可以試著填一些資料,但是當我們點選計算時會報錯,這是因為伺服器端還沒有準備好。

前端請求部分

熟悉Axios的同學可以跳過這部分,前面的程式碼裡,已經給出了Axois傳送請求的程式碼。

可以看到無論是哪一種型別的元件,請求都傳送到了相同的url("api/calcPersonTax"),以SalaryIncome為例,程式碼如下:

async function calculateTax(event) {

event.preventDefault();

let res = await axios.post("api/calcPersonTax", {

calcType: props.calcType,

income: income,

insurance: insurance,

childEdu: childEdu,

selfEdu: selfEdu,

treatment: treatment,

loans: loans,

rent: rent,

elder: elder,

});

if (res != null) {

let data = res.data;

setTaxableIncome(data.taxableIncome);

setTaxRate(data.taxRate);

setDeduction(data.deduction);

setTax(data.tax);

setTakeHomeSalary(data.takeHomeSalary);

}

}

可以看到,整個請求變得非常簡單,主要是把state的值取出來,通過post請求傳送到伺服器端,然後根據返回值,把資料重新設給state,這樣就完成UI資料的更新了。

設定請求轉發中介軟體

我們在請求時存取的是相對地址,React本身有一個nodeJS,預設的埠是3000,而Spring Boot的預設埠是8080。前端直接存取會有跨域的問題,因此我們要做一個代理的設定。

在src資料夾下面新增檔案,名為setupProxy.js,程式碼如下:

const { createProxyMiddleware } = require('http-proxy-middleware');

module.exports = function(app) {

app.use(

'/api',

createProxyMiddleware({

target: 'http://localhost:8080',

changeOrigin: true,

})

);

};

伺服器端 Spring Boot

建立工程及新增依賴

使用IDEA建立一個Spring Boot工程,如果使用的是社群(community)版本,不能直接建立Spring Boot專案,那可以先建立一個空專案,idea建立project的過程,就跳過了,這裡我們以建立了一個gradle專案為例。

plugins {

id 'org.springframework.boot' version '3.0.0'

id 'io.spring.dependency-management' version '1.1.0'

id 'java'

id 'war'

}

group = 'org.example'

version = '1.0-SNAPSHOT'

repositories {

mavenCentral()

}

dependencies {

implementation 'org.springframework.boot:spring-boot-starter-web'

implementation 'com.grapecity.documents:gcexcel:6.2.0'

implementation 'javax.json:javax.json-api:1.1.4'

providedRuntime 'org.springframework.boot:spring-boot-starter-tomcat'

testImplementation('org.springframework.boot:spring-boot-starter-test')

}

test {

useJUnitPlatform()

}

在dependencies 中,我們除了依賴Spring Boot之外,還新增了GcExcel的依賴,後面匯出時會用到GcExcel,目前的版本是6.2.0。

新增API

在Application類上,新增屬性 @RequestMapping("/api").,並新增 calcPersonTax API。

@Spring BootApplication

@RestController

@RequestMapping("/api")

public class SalaryTaxCalculator {

public static void main(String[] args) {

SpringApplication.run(SalaryTaxCalculator.class, args);

}

@PostMapping("/calcPersonTax")

public CalcResult calcTax(@RequestBody CalcParameter par) {

Workbook workbook = new Workbook();

workbook.open(GetResourcePath());

return CalcInternal(workbook, par);

}

private String GetResourcePath(){

return Objects.requireNonNull(SalaryTaxCalculator.class.getClassLoader().getResource("PersonalTaxCalcEngine.xlsx")).getPath();

}

private CalcResult CalcInternal(Workbook workbook, CalcParameter par) {

//todo

}

}

可以看到在CalcInternal方法內,我們使用GcExcel,根據calcType來判斷使用哪一個sheet來進行計算。對不同Sheet只需要通過GcExcel設值,並從特定的格子裡取值即可。

同時,我們還需要建立兩個類,CalcParameter和CalcResult。CalcParameter用於從request中把post的data解析出來,CalcResult用於在response中返回的資料。

CalcParameter:

public class CalcParameter {

public String calcType;

public double income;

public double insurance;

public double childEdu;

public double selfEdu;

public double treatment;

public double loans;

public double rent;

public double elder;

}

CalcResult:

public class CalcResult {

public double taxableIncome;

public double taxRate;

public double deduction;

public double tax;

public double takeHomeSalary;

public double monthlyWage;

public double nonTaxablePart;

}

使用GcExcel完成公式計算

前面我們定義了 CalcInternal,在 CalcInternal 中,我們需要使用GcExcel來完成公式計算。

GcExcel的公式計算是自動完成的,我們使用workbook開啟Excel檔案後,只需要set相關的value。之後在取值時,GcExcel會自動計算響應公式的值。

private CalcResult CalcInternal(Workbook workbook, CalcParameter par) {

var result = new CalcResult();

var sheet = workbook.getWorksheets().get(par.calcType);

switch (par.calcType) {

case "工資薪金所得" -> {

sheet.getRange("B1").setValue(par.income);

sheet.getRange("D1").setValue(par.insurance);

sheet.getRange("B2").setValue(par.childEdu);

sheet.getRange("D2").setValue(par.selfEdu);

sheet.getRange("B3").setValue(par.treatment);

sheet.getRange("D3").setValue(par.loans);

sheet.getRange("B4").setValue(par.rent);

sheet.getRange("D4").setValue(par.elder);

result.taxableIncome = (double) sheet.getRange("B9").getValue();

result.taxRate = (double) sheet.getRange("D9").getValue();

result.deduction = (double) sheet.getRange("B10").getValue();

result.tax = (double) sheet.getRange("D10").getValue();

result.takeHomeSalary = (double) sheet.getRange("B11").getValue();

}

case "年終獎所得" -> {

sheet.getRange("B1").setValue(par.income);

result.taxableIncome = (double) sheet.getRange("B3").getValue();

result.taxRate = (double) sheet.getRange("D3").getValue();

result.deduction = (double) sheet.getRange("B4").getValue();

result.monthlyWage = (double) sheet.getRange("D4").getValue();

result.tax = (double) sheet.getRange("B5").getValue();

result.takeHomeSalary = (double) sheet.getRange("D5").getValue();

}

case "勞務報酬所得" -> {

sheet.getRange("B1").setValue(par.income);

result.taxableIncome = (double) sheet.getRange("B3").getValue();

result.taxRate = (double) sheet.getRange("D3").getValue();

result.deduction = (double) sheet.getRange("B4").getValue();

result.nonTaxablePart = (double) sheet.getRange("D4").getValue();

result.tax = (double) sheet.getRange("B5").getValue();

result.takeHomeSalary = (double) sheet.getRange("D5").getValue();

}

case "個體工商戶、生產經營所得" -> {

sheet.getRange("B1").setValue(par.income);

result.taxableIncome = (double) sheet.getRange("B3").getValue();

result.taxRate = (double) sheet.getRange("D3").getValue();

result.deduction = (double) sheet.getRange("B4").getValue();

result.tax = (double) sheet.getRange("D4").getValue();

result.takeHomeSalary = (double) sheet.getRange("B5").getValue();

}

default -> {

sheet.getRange("B1").setValue(par.income);

result.taxableIncome = (double) sheet.getRange("B3").getValue();

result.taxRate = (double) sheet.getRange("D3").getValue();

result.tax = (double) sheet.getRange("B4").getValue();

result.takeHomeSalary = (double) sheet.getRange("D4").getValue();

}

}

return result;

}

這樣就完成了伺服器端的程式碼。

最終效果

我們可以使用工資薪金所得試驗一下,可以看到資料被計算出來了。因為目的是為了分享伺服器端公式計算的方案,所以計算的結果是否正確,就不做細緻考慮。

總結

個稅計算的場景並不複雜,主要是通過Excel完成公式計算即可,在伺服器端使用GcExcel可以大幅度降低前後端的開發難度,系統的搭建過程可以完全不需要考慮計算的邏輯。

在實際的公式計算場景中,可能往往會比個稅計算的場景複雜,藉助GcExcel這樣Excel元件庫,可以很容易的把已有的Excel檔案遷移到線上,提高工作效率。

另外,本文中分享的程式碼並不是最符合實際工作中的要求,讀者還可以從以下角度去優化自己的程式碼。

- 收入型別可以抽成列舉,這樣維護和使用起來更容易。

- 目前每一個react元件裡的冗餘度還不低,還可以繼續抽象元件,避免重複寫程式碼。

- 在伺服器端,因為公式計算的邏輯是不會變的,在實際場景中,也有可能同一時間要載入複數個Excel檔案,可以考慮把workbook常駐記憶體,來提高效能。

擴充套件連結: